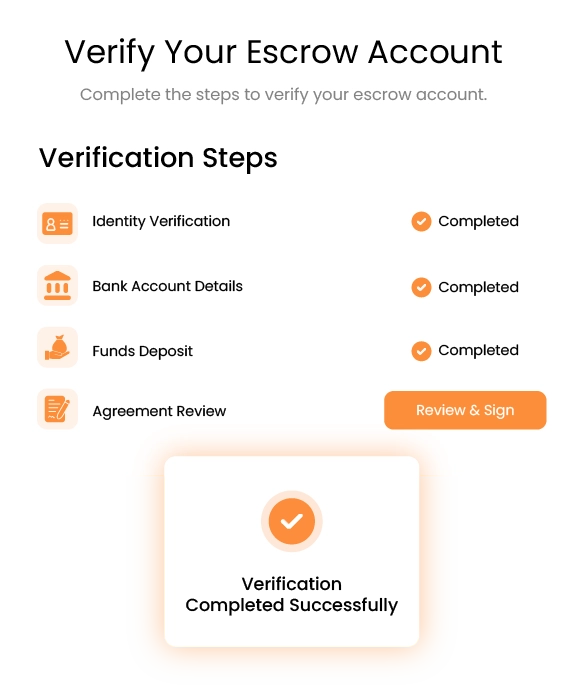

Access Tokens

Generate dynamic tokens for each session to authenticate API requests securely. Streamline operations, and maintain smooth, uninterrupted payment and transaction processing across all systems.

Tokens enable controlled access to essential payment features, boosting efficiency instantly.