Receive instant payment updates through intelligent webhooks. Improve accuracy, automate responses, and keep your systems updated with event-driven insights and delivery optimization.

Streamline complex banking tasks with programmable interfaces. Automate routine processes, reduce human error, and enhance transaction speed for consistent, reliable operations across all accounts.

Gain complete oversight of cash flows and financial health. API banking provides actionable insights, allowing businesses to optimize resources and plan growth confidently.

Secure, monitor, and manage API access across platforms

All API keys are encrypted to prevent unauthorized access and data breaches. This ensures sensitive information remains fully secure during storage.

Control access by assigning specific roles and permissions to authorized users only. This ensures minimal risk, maintains operational integrity.

Replace sensitive credentials with secure tokens for safer transactions. Tokenization reduces exposure of critical data while maintaining smooth.

Implement multiple authentication layers to enhance overall system security, combining passwords, tokens, and biometric verification for safer access.

Track every API access instantly with live monitoring dashboards. Detect unusual activity promptly, respond quickly to prevent threats and ensure reliability.

Streamline operations by linking apps directly to banking infrastructure instantly.

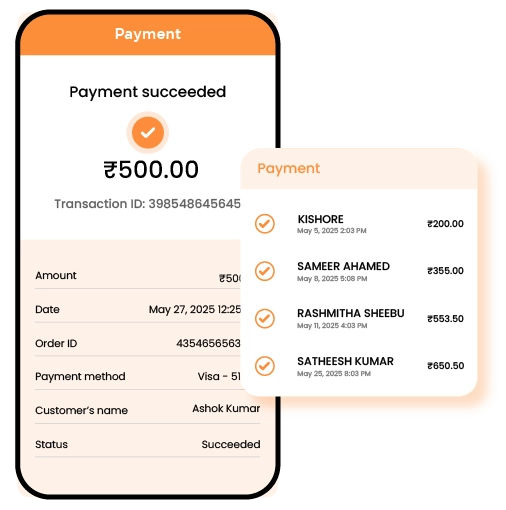

Execute payments and settlements instantly, reducing delays and manual intervention significantly.

Monitor and reconcile transactions as they happen, ensuring accurate accounts continuously.

Tailor processes to your business needs for seamless operational efficiency without fail.

Transfer sensitive financial information safely, ensuring reliability and confidentiality at all times.

Route transactions intelligently across multiple banks to optimize speed, cost, and reliability. Ensure seamless settlements while maintaining operational control and minimizing delays.

Automatically retry failed transactions based on predefined rules. Minimize manual intervention, reduce payment delays, and ensure that all critical transactions complete successfully.

Capture and record all transaction errors in detail. Analyze patterns, identify recurring issues, and maintain comprehensive logs for auditing, troubleshooting, and improving operational efficiency.

Receive instant notifications for failed or delayed transactions. Take immediate corrective action to recover payments, maintain cash flow, and ensure uninterrupted business operations across all channels.